what is the sales tax on cars in south dakota

2 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases. The base state sales tax rate in South Dakota is 45.

Pin By Rescue Alert Of California On North Dakota Seniors County Map North Dakota South Dakota

It also applies to the sale of services and all the commodities changing hands through electronic means.

. Five states have no sales tax. Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax. South Dakota Sales Tax Rate The sales tax rate in South Dakota is 45.

Compliance is complicated and time-consuming in South Dakota because of the multiple local taxing levels that must be monitored and maintained on a. The County sales tax rate is 0. In South Dakota acquire a sellers permit by following the department of revenues detailed instructions for registration.

Your businesss gross revenue from sales into South Dakota exceeded 100000. South Dakota has recent rate changes Thu Jul 01 2021. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The minimum combined 2022 sales tax rate for Aberdeen South Dakota is 65. Car sales tax in South Dakota is 4 of the price of the car.

In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees. With local taxes the total sales tax rate is between 4500 and 7500. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

Depending on local municipalities the total tax rate can be as high as 65. Depending on local municipalities the total tax rate can be as high as 65. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes admissions taxes and taxes on eating establishments.

Other taxes include telecommunications taxes tourism taxes and motor vehicle taxes. South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year. Make Bing your homepage. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Select the South Dakota city from the. In addition to the sales tax cities can levy a 2 municipal sales and use tax and a 1 municipal gross receipts tax on certain goods and services.

You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. The Aberdeen sales tax rate is 2. How to Register for South Dakota Sales Tax.

Exact tax amount may vary for different items. Construction of the 56-foot-tall lighthouse was complicated by the steep bluffs and remote location but the first light beam pierced through the darkness on March 30 1894. Car Dealership Areas In South Dakota.

By the 19th century seafarers making their way up and down the coast made the call for a lighthouse to guide their way. Does South Dakota have sales tax on vehicles. In South Dakota the sales and use tax rate is 45.

Did South Dakota v. This is the total of state county and city sales tax rates. This means that an individual in the.

Can I import a vehicle into South Dakota for the lone purpose of repair or modification. Tribal governments may also levy a sales tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special.

Motor Vehicle Sales or Purchases. You can find these fees further down on the page. How Much Is the Car Sales Tax in South Dakota.

South Dakotas sales and use tax rate is 45 percent. Different areas have varying additional sales taxes as well. The South Dakota sales tax rate is currently 45.

Though you can find automotive offerings spread out in smaller towns you may have to drive into major cities of South Dakota to find car. However the average total tax rate in South Dakota is 5814. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45.

The South Dakota sales tax and use tax rates are 45. Therefore the South Dakota sales tax is imposed on gross receipts of all retailers including the lease and sale of real or tangible personal property. Find your South Dakota combined state and local tax rate.

Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. The South Dakota SD state sales tax rate is currently 45. Colorado has the lowest sales tax at 29 while California has the highest rate at 725.

Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of 75. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

Average Local State Sales Tax. 31 rows The state sales tax rate in South Dakota is 4500. All car sales in South Dakota are subject to the 4 statewide sales tax.

Pin On Legal Form Template Waiver Download

Compare Sales Income And Property Taxes By State Us Map 2011 Property Tax Map Us Map

Pin By Jeremy Cruz On Fj40 47 Toyota Fj40 Land Cruiser Toyota Land Cruiser

Pin By Rescue Alert Of California On North Dakota Seniors County Map North Dakota South Dakota

Pin On Jerry S Chevrolet Of Beresford

5 Best Investment Investing Money Financial Finance Blog

Pin By Dylan On Rv Life Rv Life

How To Determine Your Income For Retirement Good Financial Cents Income Retirement Income Retirement

A Visual Guide To Car Maintenance Infographic Car Maintenance Car Hacks Car Essentials

The International Copyright Symbol Copyrightlaws Com Copyright Courses And Education In Plain English Copyright Symbol Symbols Copyright

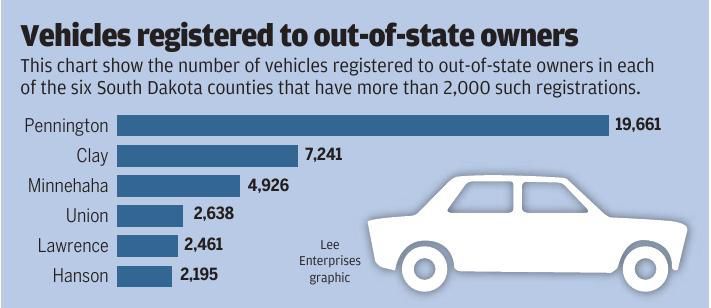

58 334 Out Of State Vehicles Registered In South Dakota Local Rapidcityjournal Com

Sales Use Tax Laws Regulations South Dakota Department Of Revenue

Street Ball Cap The North Face Ball Cap Cap Army Uniform

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation